Money, Housing and Choice

Financial, Rental and Mortgage Literacy

Empowerment Through Knowledge

Your guide to Taking Control of your money

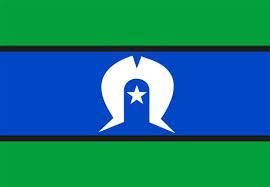

Led by NATSIHA and developed in partnership with First Nations Foundation, this project puts practical, culturally grounded tools in the hands of tenants, tenancy workers, and Aboriginal and Torres Strait Islander Controlled Housing Organisations.

Built with the sector, for the sector, it grows financial confidence, strengthens rental stability, and opens clear pathways to long-term housing security.

Thank you and Recognition

Special thanks to the Aboriginal and Torres Strait Islander housing sector – organisations, leaders and practitioners nationwide, whose insight and practical feedback shaped this booklet. Built with you, for you, to support confident conversations about money, strong tenancies and choice.

What the Project is

Tenant Financial Confidence

A hands-on “Tenant Financial Handbook” that supports yarns about money, rights and responsibilities, and planning ahead. It’s designed to be used with people, not just handed out, and it fits one-on-one conversations, group workshops, and home visits. Co-designed with housing providers and developed with First Nations Foundation so tenants can access ongoing digital tools and coaching.

What the Resource helps you to do

For Tenants and Tenancy Workers

Talk about money safely and without shame, and get support early.

Map income and expenses, set priorities, and stay on top of rent and utilities.

Understand tenant rights and responsibilities, including maintenance and privacy.

Recognise and respond to humbugging and financial abuse, including support for Elders.

Navigate rental arrears, subscriptions and digital payments, and protect against scams.

Explore steps toward home ownership when the time is right

How it was made

This project comes from sector-led priorities and national engagement. It was co-designed with Aboriginal and Torres Strait Islander housing organisations and shaped by what workers, leaders and tenants said they needed: practical tools, culturally safe delivery, and support that continues beyond a single workshop. NATSIHA partnered with First Nations Foundation to ensure the materials are strong, current, and useful on the ground.

Access More Support

First Nations Foundation

Financial Wellness Outreach

My Money My Dream